QC biz tax payment extended until end of April

The deadline for business tax payments in Quezon City is extended until April 30, the City Treasurer’s Office (CTO) announced.

The last day of payment for the first and second quarter business dues were previously set on January 20 and April 20, respectively, before a city ordinance moved it to the last day of April.

“After our own examination on the number of registrations, renewals, and payments, as well as through listening to the feedback we got from QCitizen business owners, the CTO quickly coordinated with the Business Permits and Licensing Department (BPLD) and the right offices to get an extension on the payment deadline,” CTO Head Edgar Villanueva explained.

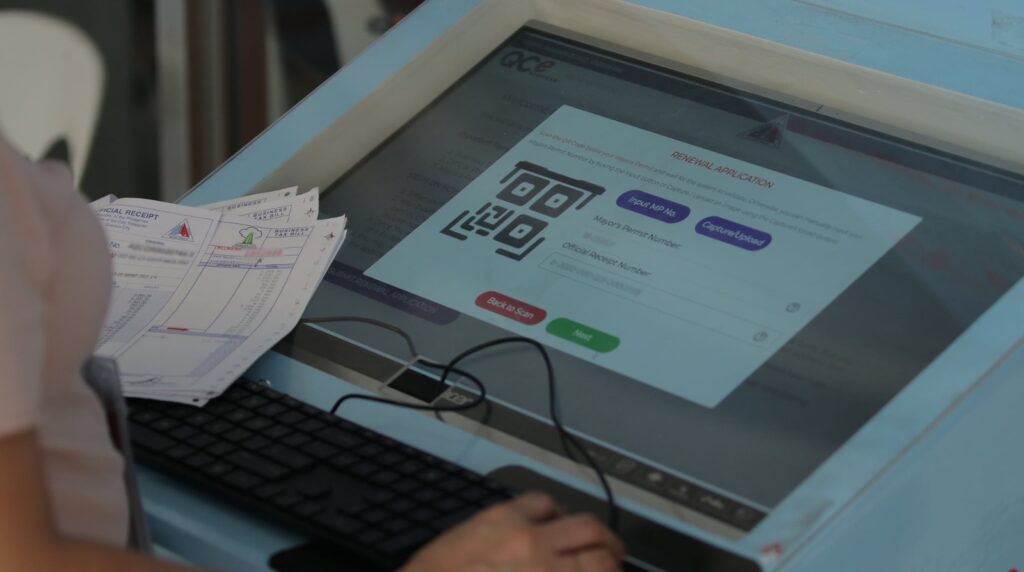

The proof of payment of business taxes is one of the requirements for businesses looking to secure a renewal of their permit.

The CTO also reminded business owners that the renewal of permits, and payment of their business taxes, fees, and other charges can be settled online through the Quezon City E-Services Website (https://qceservices.quezoncity.gov.ph/), aside from visiting the city hall in person.

“We hope to keep improving our department’s services, in alignment with Quezon City administration’s objective to establish a business environment conducive to dynamic growth and economic activity,” Villanueva added. For all business tax payment matters queries, the public can contact the Quezon City Treasurer’s Office at the city hall compound or through 8988-4242 (ext. 8317/8145/8156/8157) or via email at [email protected] and [email protected].

Subscribe to INQUIRER PLUS to get access to The Philippine Daily Inquirer & other 70+ titles, share up to 5 gadgets, listen to the news, download as early as 4am & share articles on social media. Call 896 6000.